do you have to pay inheritance tax in arkansas

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. This is one reason a cash advance is better than a probate loan or funding.

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

Estate taxes and inheritance taxes sometimes are called death taxes.

. Most people do not need to worry about estate taxes. You wont make monthly payments on the funds or pay interest. Thirteen states impose taxes of 5 of the purchase price or less including five states where the tax is just 4.

You are also required to maintain liability insurance on your vehicle. However you may have expenses especially if you are the administrator. Important Details about Free Filing for Simple Tax Returns If you have a simple tax return you can file with TurboTax Free Edition TurboTax Live Basic or TurboTax Live Full Service Basic.

The complicated stuff firstthe tax treatment of inherited land can be tricky and may vary from state to state. Long-term capital gains receive an exemption of 50 meaning that 50. Its even better than using a credit card which would require you to pay interest if you couldnt pay the balance in 30 days.

Even if you have real estate in the inheritance it isnt in your name. If you choose to name a charity as your beneficiary then the proceeds are free from income tax. If your home of record is other than Arkansas and you are stationed outside of Arkansas you must register your.

The rest of the states all impose a sales tax that ranges from 55 to. However Congress revises the estate tax laws from time to time so you should learn what the current estate tax exemption is when creating your trust. Among states that do have a sales tax some are less significant than others.

If you live in Montana and need to file for dissolution of marriage divorce youll need to know about the law and procedures. That means you pay the same income tax rates as you do for other income in the state. An option with a lower tax exposure is to have the death benefits paid over the life expectancy of the beneficiary.

In most states these are faster and May 02 2022 4 min read. In 1993 Queen Elizabeth II agreed to pay the highest tier of income tax and in exchange the Royal Family would be exempt from paying inheritance tax. Arkansas Capital Gains Tax.

This means that benefits will be paid out over a longer period of time. If you and your spouse agree on the terms of a divorce then you may be able to get an uncontested divorce. You may wonder When do you have to pay inheritance tax on the estate.

Learn the residency May 02 2022 6 min read. Judge the Costs. Before you put a retainer on a lawyer engage in some sober second thoughtIf you are not family and were never named in a previous will you have no standing to contest the will.

Few states have estate or inheritance taxes and the federal government only assesses such taxes on estates with significant assets. As a beneficiary consult with an experienced tax attorney and accountant to fully understand the most up-to-date legal and tax implications of your inheritance. Many inheritances are lost during probate because of someone contesting the will.

Only certain taxpayers are eligible. Capital gains are taxable as personal income in Arkansas. Before renewing your license you are required by Arkansas law to assess your vehicle with your county assessor and pay all personal property taxes you owe.

Arkansas has no estate or inheritance tax. Inheritances is also exempt from the Arkansas income tax. Once you sign the paperwork to receive your funds the terms cannot change.

Is There An Inheritance Tax In Arkansas

Arkansas Inheritance Laws What You Should Know

Arkansas Estate Tax Everything You Need To Know Smartasset

Create A Living Trust In Arkansas Legalzoom

Arkansas Month To Month Lease Agreement Pdf Template Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

How To Handle A Small Estate In Arkansas

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Estate Tax Everything You Need To Know Smartasset

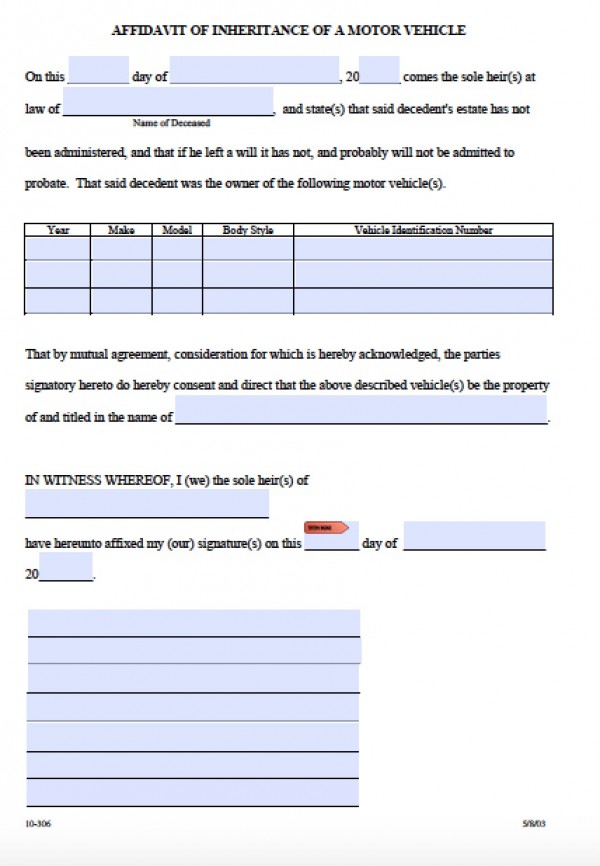

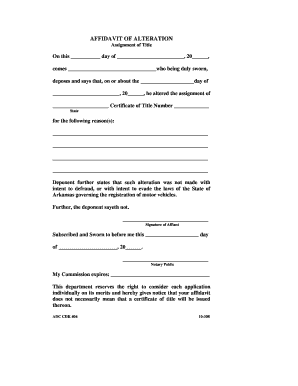

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

Arkansas Advance Legislative Service Lexisnexis Store

Bill Of Sale Form Arkansas Affidavit Of Inheritance Of A Motor Vehicle Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

Arkansas Sales Tax Exemption Form Form Tax Arkansas

Historical Arkansas Tax Policy Information Ballotpedia

Arkansas State Tax Guide Kiplinger

Arkansas Inheritance Laws What You Should Know

Aerial Photo Little Rock Arkansas Aerial Photo Little Rock Arkansas Aerial